does massachusetts have estate tax

It is assessed on estates valued at more than 1 million. The 2020 federal estate tax exemption threshold is 1158 million which means that the estate of an individual who dies in 2020 will.

State Estate And Inheritance Taxes Itep

In Massachusetts an estate tax is generally applied to estates which exceed 1 million based on a progressive rate scale with rates starting at 08 and increasing to 16.

. Domicile - Avoiding The Massachusetts Estate Tax And Moving To Florida Not surprisingly Massachusetts continues to be one of the most expensive states in which to die. A family trust can have significant savings for Massachusetts couples in this example 200000. 402800 55200 5500000-504000046000012 Tax of 458000.

The Massachusetts estate tax is a. Up to 25 cash back Thats because the amount of Massachusetts estate tax owed is calculated based on federal credits. Massachusetts Estate Tax Overview.

Any Massachusetts resident who has. Massachusetts Estate Tax Rates. If your estate exceeds 1206 million and does owe.

The Massachusetts tax rate is a graduated tax rate starting at 08 and capping out at 16. Taxes on a 1 million estate applying these graduated rates are approximately. The graduated tax rates are capped at 16.

The Massachusetts estate tax law MGL. Unlike most estate taxes the. Does Massachusetts Have an Inheritance Tax or Estate Tax.

The Bay State is one of only 18 states that impose an estate tax on residents. Was enacted in 1975 and is applicable to all estates of decedents dying on or after January 1 1976. Any family estate in Massachusetts worth 1 million can benefit from.

Massachusetts does levy an estate tax. Example - 5500000 Taxable Estate - Tax Calc.

Raise The Threshold On Massachusetts Estate Tax Gop State Legislator Says Newbostonpost Newbostonpost

Minimizing Estate Taxes In Massachusetts

Estate Tax Changes Appearing More Likely In Massachusetts Boston News Weather Sports Whdh 7news

Review Outlook The Die Harder States Wsj

Inheritance Tax Here S Who Pays And In Which States Bankrate

Death And Taxes Front And Center In Massachusetts

Inheritance Tax Here S Who Pays And In Which States Bankrate

Common Massachusetts Estate Tax Planning Methods T Frank Law Pllc

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

How Does Massachusetts Tax Estates Of Non Residents With In State Real

What Do I Pay On Taxes For An Estate In Massachusetts Mcnamara Yates P C

Inheritance And Estate Taxes Can Impact Ordinary Taxpayers Too

How Much Is Inheritance Tax Community Tax

Moved South But Still Taxed Up North

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

How Does Massachusetts Track Gifts For Estate Tax Return

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

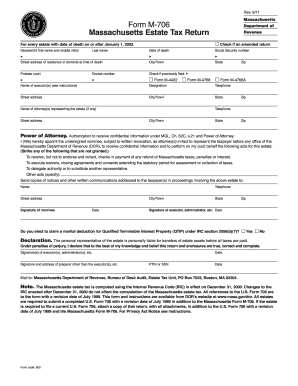

My Estate Tax Return Form Fill Out And Sign Printable Pdf Template Signnow

What Is The Estate Tax In Massachusetts Massachusetts Probate Law Mcnamara Yates P C